Fort Collins Bankruptcy Court Records

Fort Collins is a vibrant city. About 170,000 people live here. Colorado State University is here. The city has a strong economy. But residents still face debt. Some file bankruptcy. This page shows how to find their records. It explains the search process for Fort Collins residents.

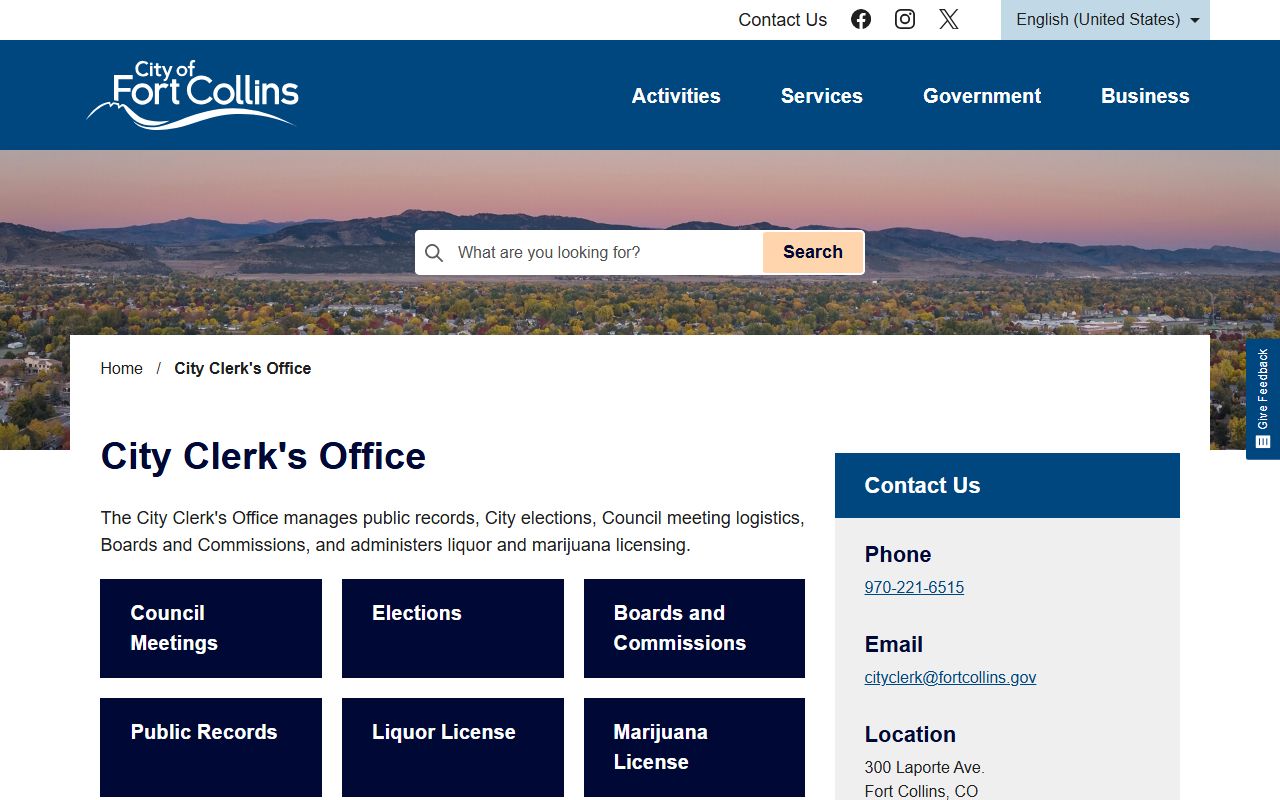

Fort Collins City Clerk

The City Clerk keeps city records. The office is at 300 LaPorte Avenue. The phone is 970-221-6515. Hours are 8:00 AM to 5:00 PM. The clerk manages council records. They run city elections. They handle public requests.

The City Clerk does not keep bankruptcy records. Those are federal. They are in Denver. But the clerk has other records. They have council minutes. They have city contracts. They have ordinances. These are public. You can request them.

Fort Collins is a home rule city. It has its own charter. The city operates independently. The clerk ensures transparency. Records are open to all. Visit in person. Or use the website.

Fort Collins is in Larimer County

Fort Collins is the county seat. Larimer County is in northern Colorado. It includes the mountains. It includes the plains. The county is diverse. Fort Collins is the largest city.

For county records, visit Larimer County. They have property records. They have court files. They have marriage licenses. Visit the Larimer County page for more. The office is in Fort Collins.

Colorado State University is here. Many students live here. Graduates stay here. The population is educated. But financial problems affect everyone. Job loss happens. Medical debt happens. Divorce happens. Bankruptcy is a tool.

Note: Fort Collins residents file bankruptcy in Denver, not at the Larimer County courthouse.

Federal Court for Fort Collins Residents

The U.S. Bankruptcy Court is in Denver. The address is 721 19th Street. Fort Collins is north of Denver. It is about sixty-five miles away. The drive takes over an hour. Take I-25 south. Plan for traffic.

The court phone is 720-904-7300. The website is www.cob.uscourts.gov. Check it for information. It has forms. It has fees. It explains procedures.

The court is secure. Bring valid ID. Pass through screening. No weapons allowed. Staff are helpful. They assist visitors. They help with records.

Hours are 8:00 AM to 5:00 PM. Records close at 4:30 PM. Arrive early. Parking is nearby. Public transit is available in Denver. The light rail stops close.

Search Fort Collins Bankruptcy Records with PACER

PACER is the online tool. It is essential for Fort Collins residents. It saves a long drive. Use it at pacer.uscourts.gov. Create an account. Registration is free. Add a credit card.

Fees are reasonable. Ten cents per page. Three dollars per document max. Fees under thirty dollars per quarter are waived. Many users pay nothing. This is ideal for Fort Collins residents.

Search by name. Use last name first. Add first name. Case numbers work too. Results are instant. Click to view. Download PDFs. Save to your computer.

PACER has records from 2001. Older cases are archived. You can request them. Contact the court. Ask for archived records. Staff will retrieve them. It takes some time.

The voice system is free. Call 866-222-8029. Press extension 26. Get basic case info. Learn the status. Find next dates. Available twenty-four hours.

What Records You Can Find

Bankruptcy records are comprehensive. They contain many documents. Here are the main ones:

- Petition - the form that starts the case

- Schedules - detailed lists of assets and debts

- Statement of Financial Affairs - financial history

- Meeting notice - the 341 meeting details

- Discharge order - eliminates qualifying debts

- Dismissal order - closes case without discharge

Each document tells part of the story. Together they show the whole case. You can see what was filed. You can see court actions. You can see the outcome.

Records are public forever. They never expire. Anyone can search them. Credit reports show ten years. PACER shows all years. This is a key difference.

Legal Help for Fort Collins Residents

Fort Collins has legal resources. Colorado Legal Services helps. They serve low-income residents. Visit coloradolegalservices.org. They have a northern Colorado office. Call for an appointment.

The Pro Se Clinic helps. Volunteer lawyers assist. They review forms. They answer questions. Visit cobar.org/bankruptcy for schedules. Sometimes the clinic meets in northern Colorado.

CSU has a law school program. Students may help. They work under supervision. Services are limited. But they are worth checking. Contact the law school.

Credit counseling is required. Take it before filing. Take it after too. Approved agencies offer it. Online courses are available. Phone courses are available. Fees depend on income.

Filing Bankruptcy from Fort Collins

Fort Collins residents file in Denver. It is a long trip. Plan ahead. Bring your documents. Bring ID. Bring payment or a waiver. Chapter 7 fee is $338. Chapter 13 fee is $313.

Filing fees can be paid in installments. You can request a payment plan. Waivers are available too. Low-income filers may qualify. Ask the court about options.

After filing, you get a case number. You get a trustee. They review your case. You attend a meeting. This is the 341 meeting. It is usually in Denver. Check your notice.

At the meeting, the trustee asks questions. You answer under oath. Be honest. Bring documents. The meeting is brief. Usually ten to fifteen minutes. Creditors rarely attend.

Chapter 7 takes three to six months. Then you get discharge. Chapter 13 takes three to five years. You make monthly payments. Then you get discharge. Follow all rules. Complete all requirements.